V-Esprit 55+ Active Adult Community

Maintenance-Free Independent Senior Living

Welcome Home to V-Esprit

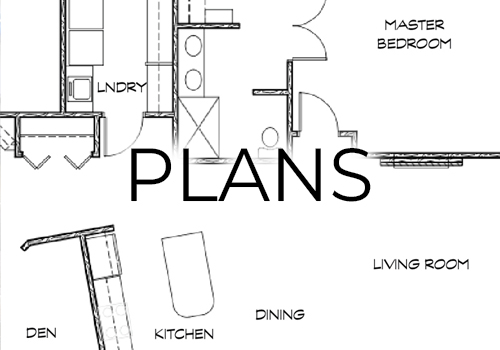

We offer 2-bedroom/2-bath + den Villas, 2-bedroom/2-bath + sunroom Patio Homes, and 1- and 2-bedroom Apartments in our Main Building. Apartment and Patio Home monthly fee covers all living expenses including utilities (electric, gas, water, trash), cable TV, high-speed Internet and wi-fi. All units include pool and fitness center membership,in-house theater, gym, and library, light housekeeping, most on and off-campus transportation, a wide range of daily events and activities, complimentary concierge services, home maintenance and more.

Stop by today for a tour and to experience our carefree, vibrant community.

* * *

The Villas at V-Esprit Are Now Open

For more information, click here, or call Peter at 303.400.2399 to schedule a personal tour.

What they're saying about us...

“I feel like I'm part of a close family. ”

Click here to see more

Two can live as cheaply as one!

(click for details)

Share a Place

V-Esprit offers different living options to meet your personal lifestyle. Consider our "Share-A-Place" option which allows you to live with a family member, friend, helper or someone compatible with you.

Many people are discovering the added benefits of shared living.

Here are just a few:

• "I lost my spouse and felt alone and isolated."

• "It helps us both with shared living expenses."

• "I don’t drive but my housemate does, so this works for us."

• "I like living with and sharing experiences with someone my own age."

• "As housemates, we enjoy all the activities."

SEE HOW OUR OPTIONS FIT TODAY'S LIFESTYLES!

Renting vs. Buying

See How Renting Can Make Financial Sense.

Renting vs Buying

I have something un-American to confess: I rent an apartment, despite having enough money to buy a house. I plan to keep renting for as long as I can. I'm not just holding out for better prices. Renting will make me richer.

I normally write about stocks for SmartMoney.com, but the boss asked me to explain to readers my reason for renting. Here goes: Businesses are great investments while houses are poor ones, so I'd rather rent the latter and own the former.

Stocks vs. Houses: Returns

Shares of businesses return 7% a year over long time periods. I'm subtracting for inflation, gradual price increases for everything from a can of beer to an ear exam. (After-inflation or "real" returns are the only ones that matter. The point of increasing wealth is to increase buying power, not numbers on an account statement.) Shares have been remarkably consistent over the past two centuries in their 7% real returns. In Jeremy Siegel's book, "Stocks for the Long Term," he finds that real returns averaged 7.0% over nearly seven decades ending 1870, then 6.6% through 1925 and then 6.9% through 2004.

The average real return for houses over long time periods might surprise you. It's zero.

Shares return 7% a year after inflation because that's how fast companies tend to increase their profits. Houses have their own version of profits: rents. Tenant-occupied houses generate actual rents while owner-occupied houses generate ones that are implied but no less real: the rents their owners don't have to pay each year. House prices and rents have been closely linked throughout history, with both increasing at the rate of inflation, or about 3% a year since 1900. A house, after all, is an ordinary good. It can't think up ways to drive profits like a company's managers can. Absent artificial boosts to demand, house prices will increase at the rate of inflation over long time periods for a real return of zero.

Robert Shiller, a Yale economist and author of "Irrational Exuberance," which predicted the stock price collapse in 2000, has recently turned his eye to house prices. Between 1890 and 2004 he finds that real house returns would've been zero if not for two brief periods: one immediately following World War II and another since about 2000. (More on them in a moment.) Even if we include these periods houses returned just 0.4% a year, he says.

The average pundit, planner, lender or broker making the case for ownership doesn't look at returns since 1890. Sometimes they reduce the matter to maxims about "building equity" and "paying yourself" instead of "throwing money down the drain." If they do look at returns they focus on recent ones. Those tell a different story.

Between World War II and 2000 house prices beat inflation by about two percentage points a year. (Stocks during that time beat inflation by their usual seven percentage points a year.) Since 2000 houses have outpaced inflation by six percentage points a year. (Stocks have merely matched inflation.)

In the News

V-Esprit is a great option for seniors downsizing or retiring - and selling while the market is high! See the whole story featured in the Denver Post.

Click here.

Independent Senior Living

For more information, click here. Review our Privacy Policy.

©2026 V-Esprit Enterprises, Inc. All rights reserved.